Financial management mobile application background

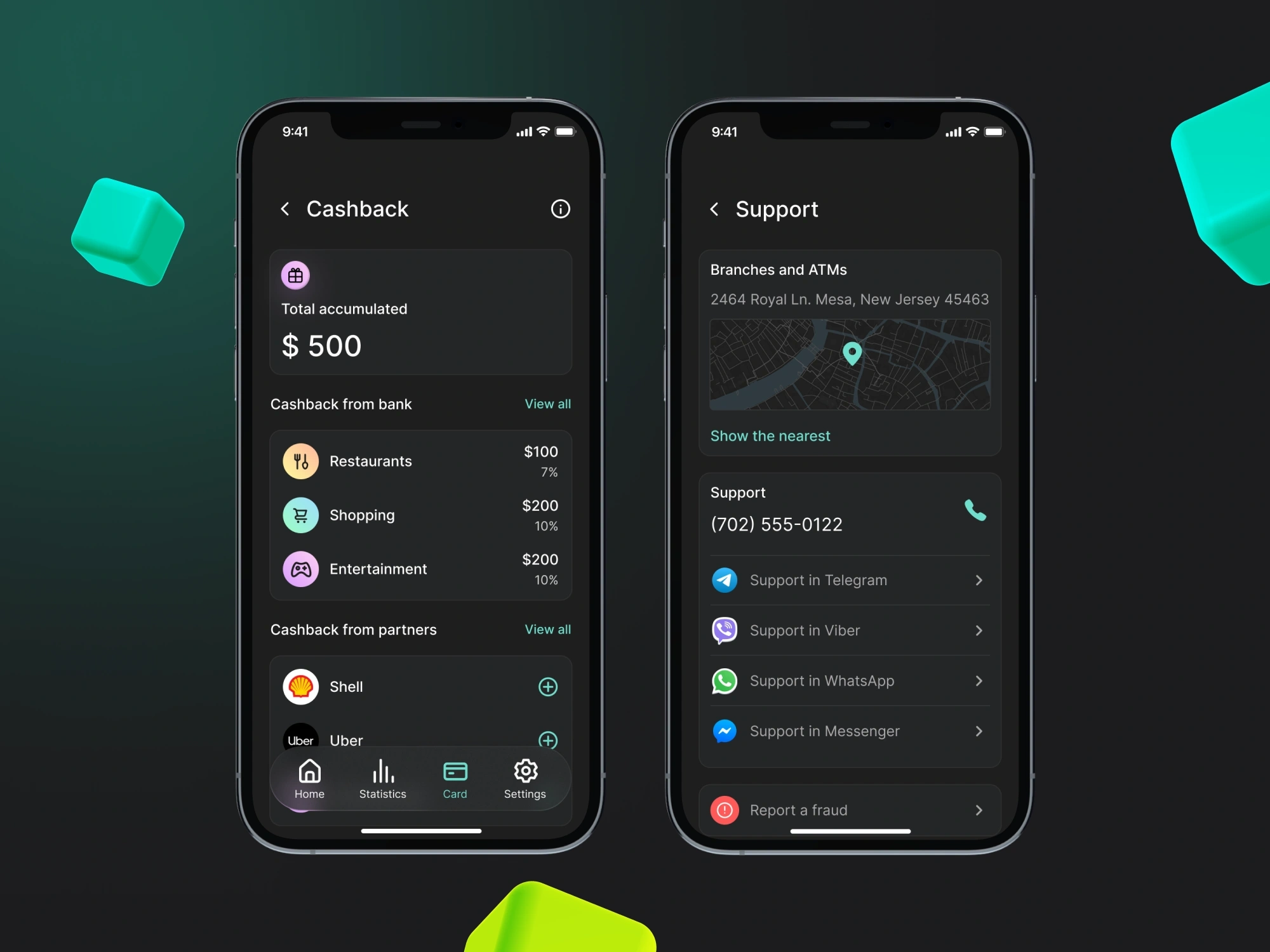

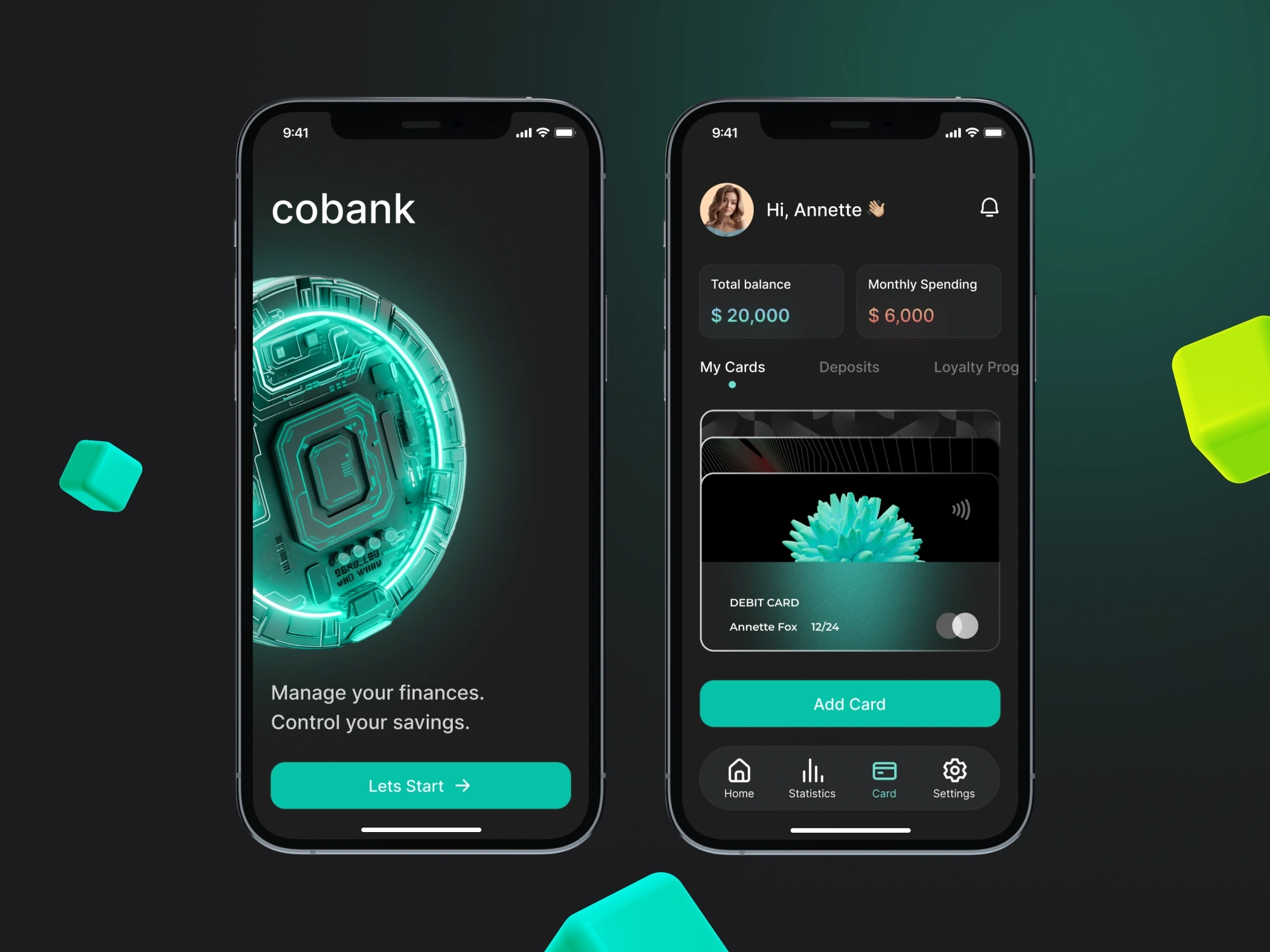

The idea behind this comprehensive mobile app comes from the growing global demand for financial wellness tools. The client approached us to create a solution that covers four key aspects of financial success: simple saving, spending control, an investment solution, and robust financial analytics. Furthermore, the fintech software development aimed to include integration with banking services and numerous cashback categories.

Key features that were deployed in fintech mobile app development

In order to meet our objectives and surpass client expectations, we’ve conducted a fintech mobile app development process to implement the following features:

- The fintech mobile app features a multi-card management tool for convenient payments using various credit cards, both for US and international transactions. As a financial technology institution, this mobile app requires integration with banking services to facilitate payments. To achieve this, we developed a comprehensive feature that smoothly integrated with a leading US bank.

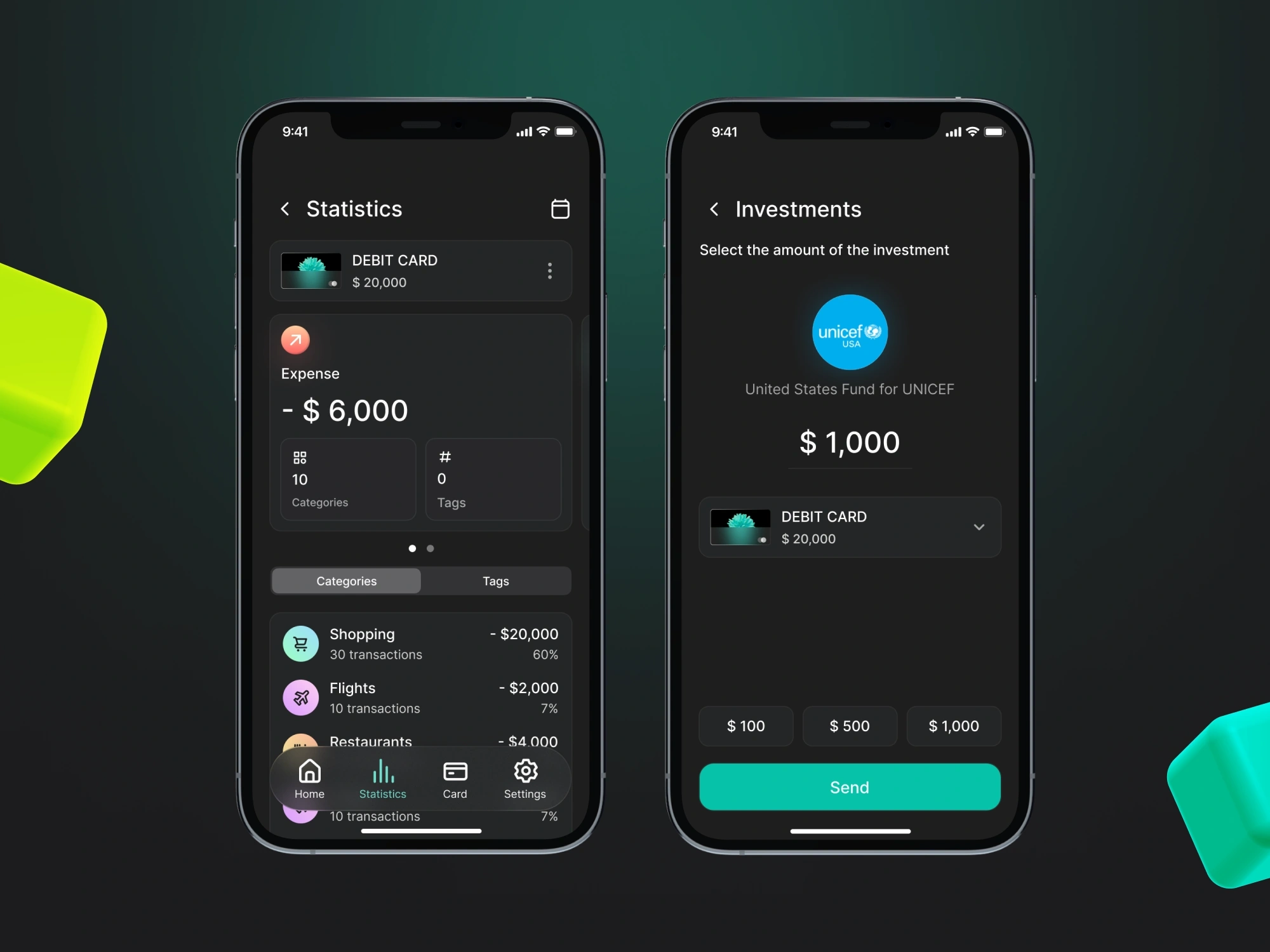

- To offer an investment solution, we implemented a customized investment portfolio feature that enables users to create and personalize multiple investment options. This empowers users to diversify their assets across various projects, enhancing their financial well-being directly within the app while maintaining control over investment rates.

- The comprehensive customized dashboards represent a pivotal element of this fintech mobile app. Users no longer require budget journals when utilizing this mobile app, as all financial statistics are consolidated within interactive and user-friendly dashboards.

Value provided by fintech app development

With our fintech app development services, we’ve crafted a complete financial ecosystem within a single mobile app. In addition to the aforementioned key features, this mobile app enables users to enhance their financial well-being through a wide array of cashback categories, encompassing nearly all spending categories within the app. To position this app as an all-in-one solution, we’ve also created a goal-setting tool, empowering users to establish and monitor their financial objectives.