About the client and collaboration with him

The Corpsoft team was approached by two entrepreneurs of the insurance industry. They are experts in the field of accounting of insurance documents and understand the nuances of effective conducting business in this industry. Our clients identified opportunities for other companies as well, which also need strict accounting of their documents as part of their internal processes. The request was to develop a tool to process and analyze insurance checks, which would help reduce the risks of errors and accounting discrepancies.

Product description and challenges

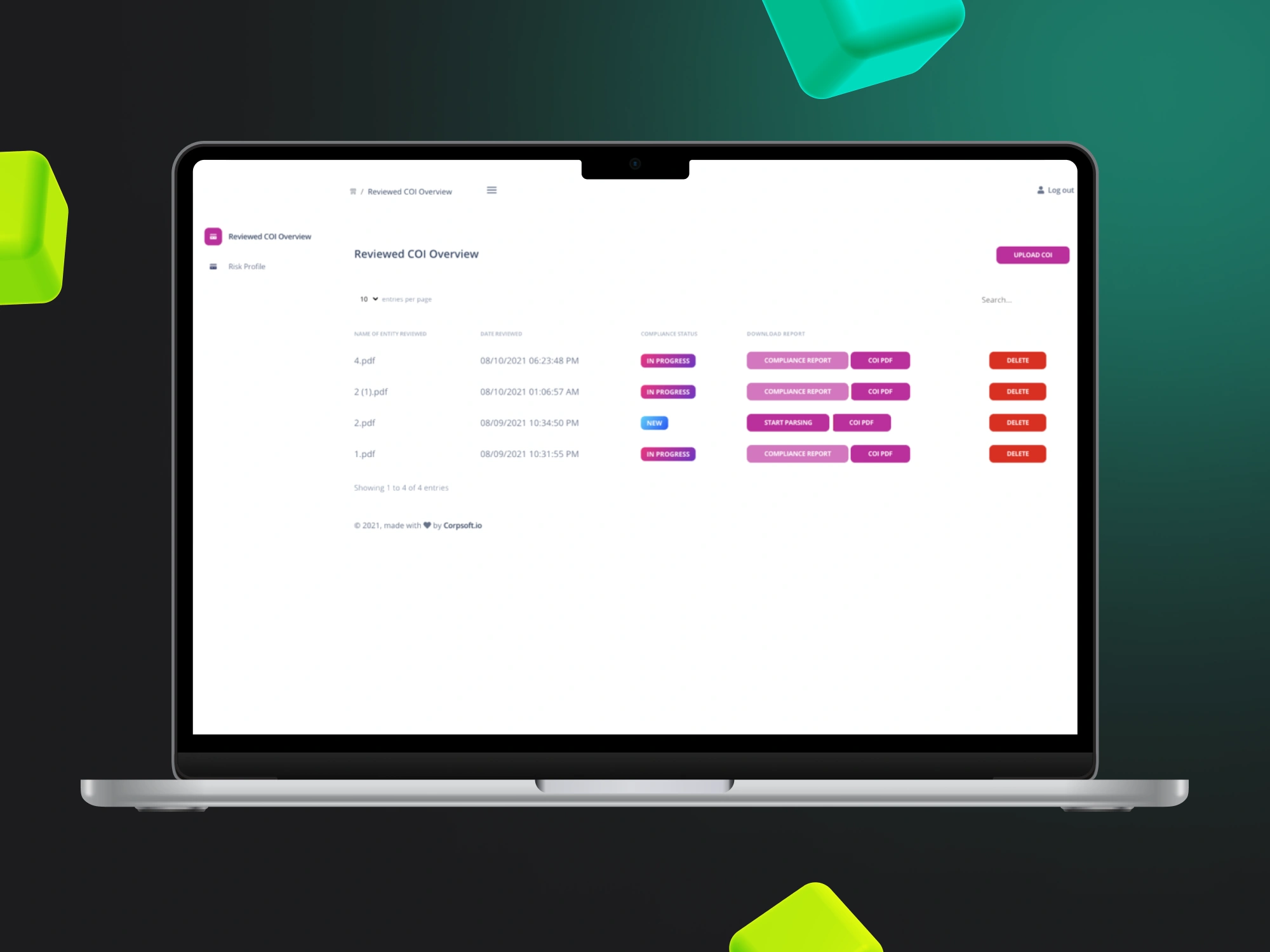

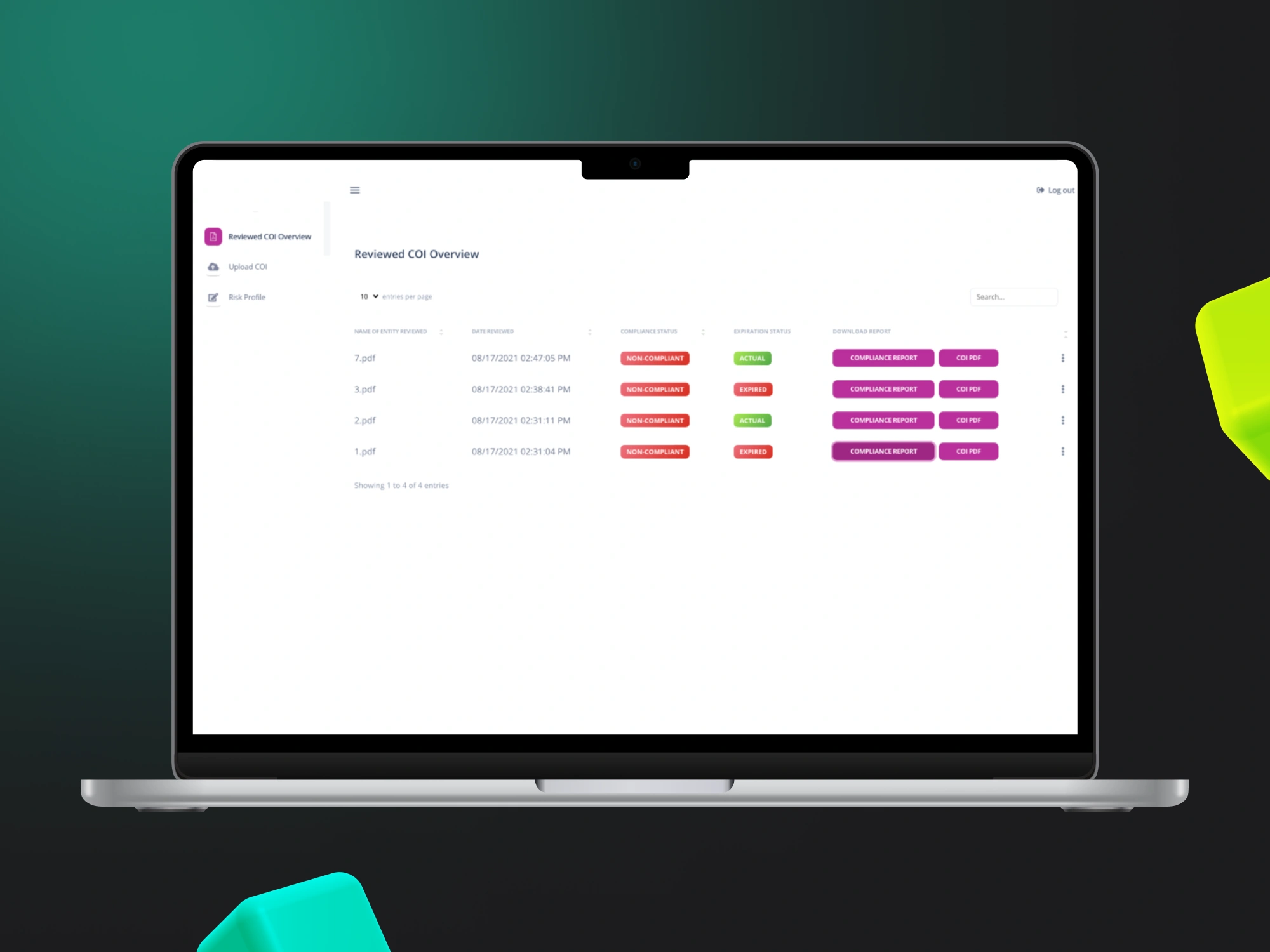

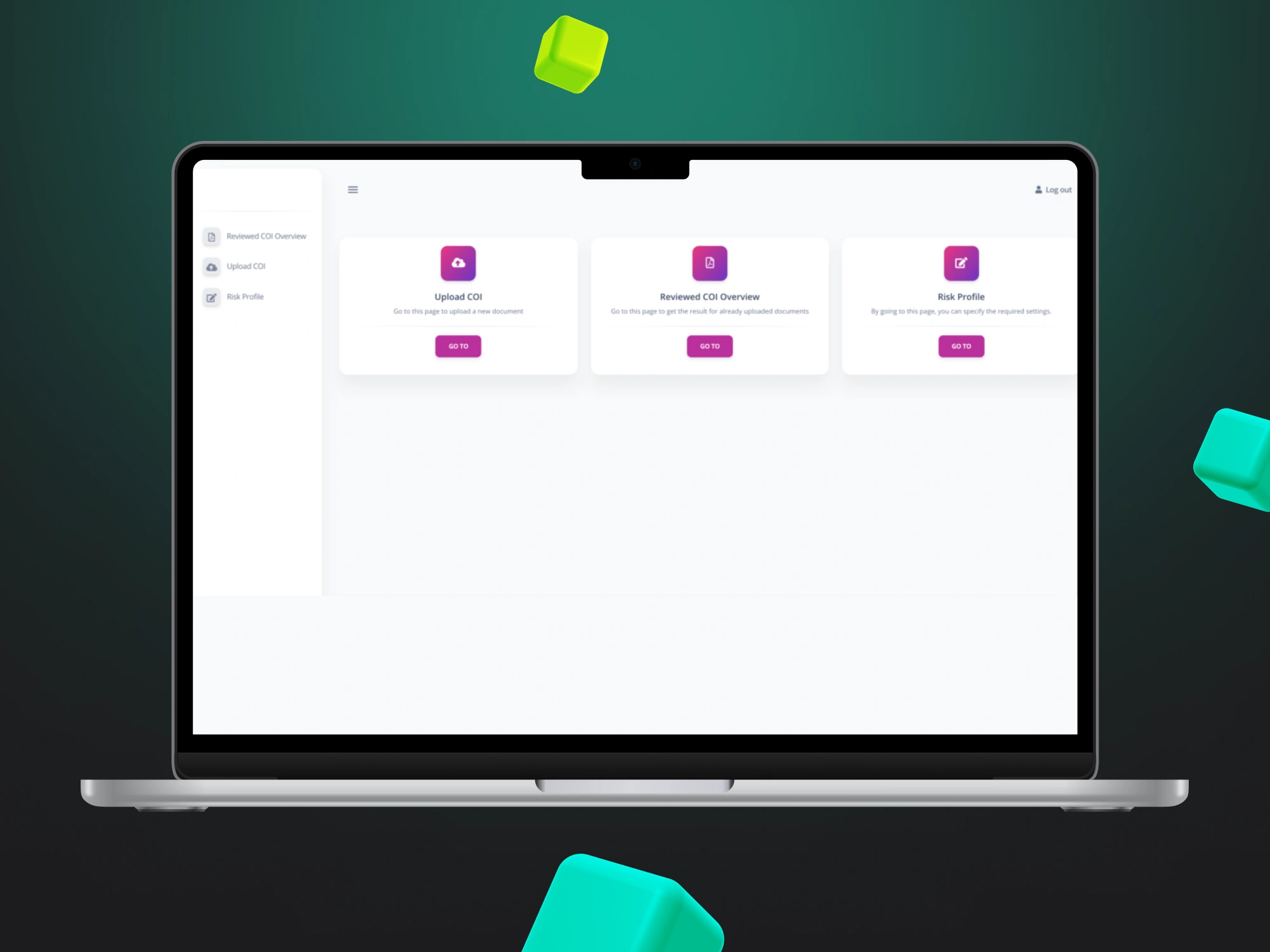

This project provides the development of a custom system for processing insurance checks that will allow reviewing and monitoring a large volume of documents for their compliance with processes and approvals. In order to implement this tool, we need to develop a program that can read and parse PDFs of insurance checks and compare the data in them to specified requirements.

One of the main challenges of this project is to create a system that will automatically process and compare a huge number of insurance checks in real time. Also an important factor is to develop processing algorithms that will determine the compatibility of insurance checks quickly and correctly in accordance with the specified requirements.

Key Project Features

The project has a number of key features that make it meaningful and useful for companies that process large insurance document amounts. They include:

1. Processing massive volumes of insurance documents in real time and accuracy in determining their compliance according to specified requirements. As technical partners, we proposed to achieve this by using modern software and algorithms to optimize the companies’ documents accounting processes.

2. Parsing and reading PDF files. PDF parsing involves extracting information, such as text, images, metadata, from PDF documents. Reading PDFs involves taking data from a PDF file and presenting it in an easy-to-use format.

3. Highlighting nonconformities. This allows you to quickly and accurately determine the compatibility of insurance documents, which is the main advantage of the project, which simplifies the operations.

Value of development

As a result of our experience and expertise, the corpsoft team has developed a tool that helps businesses reduce document processing time and provide more accurate data analysis. The system’s value is that this tool is required for companies that process large volumes of documentation, because it simplifies and speeds up the insurance check validation workflow and ensures compliance with processes and approvals by automating it. The system significantly reduces the time it takes to process data, as well as providing improved analysis and ensuring compliance with processes and approvals by automating their review.