Are payments being lost? Are medical billing processes slowing down payments and creating chaos in documents?

These questions often arise for business owners, and the healthtech sector is no exception. We frequently hear complaints from healthcare business managers or startup founders that clumsy paperwork and bureaucracy are costing them hours, money, and nerves. What they want is one solution — to automate all of this chaos while reducing costs, speeding up payments, and minimizing errors to almost zero.

It may sound utopian, but it is possible! In this article, we’ve gathered all the important information in simple language about how EDI transactions in healthcare are helping medical companies, from clinics to insurance providers, transition from paper delays to digital efficiency.

You will learn what electronic data interchange software is, how the EDI 835 differs from the 837, and how EDI for healthcare can help your business achieve a new level of automation. Let’s dive in.

What is EDI, and Why Is It Needed for Your Healthcare Business?

Imagine you can reduce manual work in document processing, eliminate time losses when approving bills, and receive payments from insurers much faster. This isn’t fantasy — it’s EDI.

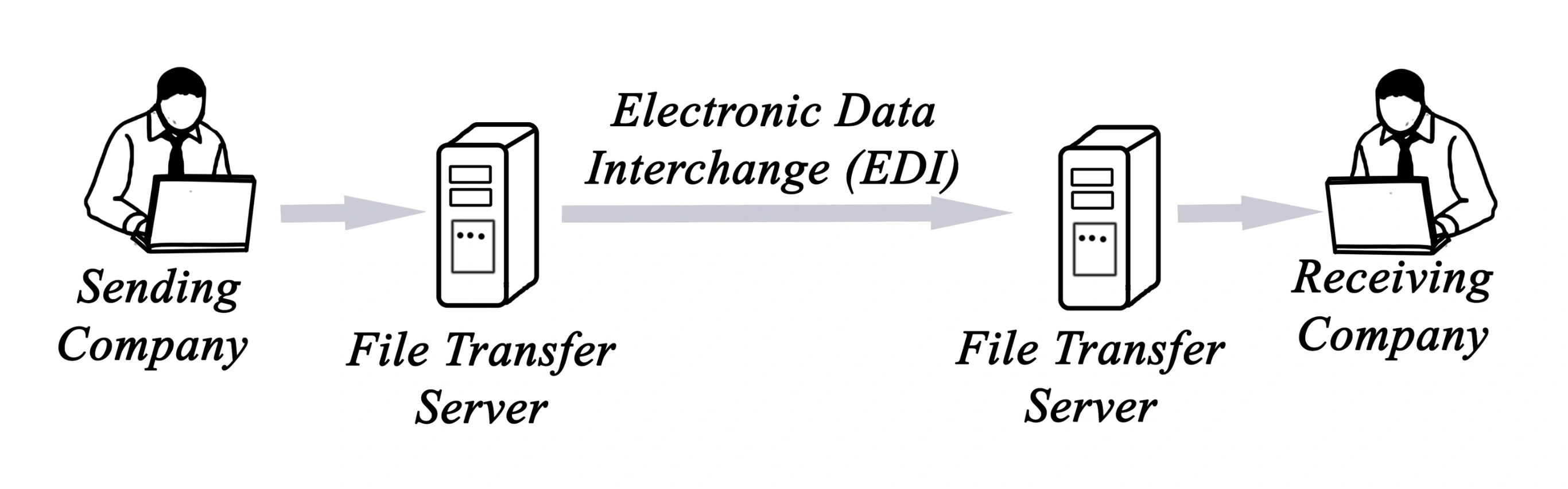

In simple terms, EDI (Electronic Data Interchange) is a standardized electronic exchange of business documents between organizations. Instead of sending papers, employees manually filling out forms, or wasting time on phone calls and clarifications, everything happens instantly, accurately, and according to pre-established standards.

In the healthcare context, EDI healthcare is used for:

- Sending insurance claims;

- Receiving payments (e.g., through the 835 file);

- Processing clinical data and lab results;

- Sending referrals for procedures (e.g., using the EDI 278 transaction);

- Managing billing and denials.

💡 Interesting fact: Organizations implementing EDI save up to 60% of time on document processing and reduce errors by 30–40%.

What Benefits Do You Get?

- Reduction in document processing costs and personnel expenses;

- Faster processes — from submitting claims to receiving payments;

- Minimization of errors that delay payments;

- Compliance with HIPAA EDI standards is crucial for security.

If your staff is starting to complain about the endless “manual routine” in administration, there’s a solution for you — EDI for healthcare. This is precisely the solution worth considering.

What EDI Transactions in Healthcare Are There – and Why It’s Important for Your Business

EDI in healthcare is not just “one system.” It’s a set of specialized electronic messages that process various stages of interaction between clinics, laboratories, insurance companies, and other participants.

Each type of transaction serves a specific function. Below are key transactions that directly affect payment speed, cost reduction, and process automation:

EDI 837 – Electronic Submission of Insurance Claims

EDI 837 is the standard electronic format used for submitting insurance claims for medical services. It replaces traditional paper forms, such as CMS-1500, and ensures quick and accurate data transfer from the healthcare provider to the insurer.

Benefits of EDI 837:

- Error Reduction: Automating claim submission reduces errors related to manual data entry, which minimizes the chances of claim rejection.

- Faster Processing: Electronic claims are processed faster, speeding up payment receipt.

- HIPAA Compliance: EDI 837 complies with HIPAA standards, ensuring the security and confidentiality of the transmitted information.

How It Works in Practice?

Let’s take, for example, a private clinic that sees dozens of patients each day. After each visit, the administrator manually fills out insurance forms, sends them by fax or email, and then waits for weeks for a response from the insurance company. Errors happen constantly: incorrect codes, missing dates, wrong insurance numbers. The result: rejected claims, delayed payments, and stressed-out accounting.

Now, let’s imagine a different scenario. In this same clinic, an EDI 837-enabled system is implemented. After the patient’s visit, the doctor simply enters the data into the electronic medical record. The system automatically generates the claim, checks it for errors, and sends it to the insurer, without human involvement. A few days later, the EDI 835 file arrives — an answer with the payment decision. Everything is fast, transparent, and error-free.

This type of automation benefits not only clinics but also medical billing companies that service dozens of clients simultaneously. Instead of hundreds of emails and calls, they have a centralized dashboard with EDI statuses: sent, received, paid, and rejected. This saves them hours of work and increases accuracy.

Behind the scenes of this process is specialized healthcare EDI software that can handle EDI 837 formats, automatically creating and sending files in compliance with HIPAA standards. Even if you are not a technical expert, these solutions can be implemented and adapted to meet the needs of your business, so you receive payments for services quickly and without issues.

By the way, would you like your clinic to operate according to the second scenario? It’s possible — and we can help you set up this process from scratch.

EDI 835 – Electronic Payment Notification from Insurance Company

EDI 835, also known as Electronic Remittance Advice (ERA), is an electronic notification from the insurer about the payment status of submitted claims. It contains detailed information on payments made, withholdings, and reasons for rejections.

If you manage a multi-specialty clinic, you provide services, send claims to insurance companies using EDI 837, and wait for payment. But then comes the EDI 835 document — and it’s not just a simple “yes” or “no.” It’s a full report on the fate of each claim: which amount was approved, how much was withheld, which procedure codes failed, and why.

EDI 835, or Electronic Remittance Advice (ERA), helps decode how the payment (or non-payment) for a medical claim was processed. It replaces the paper Explanation of Benefits (EOB), which used to come by mail.

Who Can Use EDI 835 and How It Works?

- Healthcare Institutions (Clinics, Hospitals, Laboratories)

Receiving EDI 835, the accounting department can immediately see which amounts have been received and for which claims. This eliminates the need to manually reconcile bank statements with EOBs, streamlining accounting and speeding up financial period closures.

- Billing Companies

Thanks to EDI 835, contractors who handle billing for clinics can automatically match the received payments with the submitted EDI 837. This not only accelerates the process but also helps quickly identify and correct errors or discrepancies.

- Billing and Accounting Software

Most modern EDI billing software systems and electronic health record platforms (EHR/EMR) already support receiving and decoding EDI 835. Examples include AdvancedMD, DrChrono, and Kareo. These systems automatically allocate payments to claims, mark their status (paid, rejected, partially paid), and notify staff in case of problems.

Why Businesses Choose It?

- Reducing Human Error: Automatic data matching eliminates errors in manual entry that can lead to double-counting or missed payments.

- Real-Time Reporting: You can see finances in real-time — how much has been billed, paid, rejected, and why.

- Process Control and Improvement: By seeing frequent rejection reasons (e.g., incorrect service code or unverified coverage), you can adjust internal processes to increase approval rates.

EDI 835 is a step toward fully automating revenue cycle management, providing you not just with data but with control over it. And if you want your billing to run on autopilot like large network clinics, choose experts who can adapt to businesses of any scale, from private practices to medical networks.

EDI 270/271 – Patient Insurance Coverage Verification

Perhaps you’ve encountered a situation where a new patient came to your clinic, confident that their insurance covered the necessary procedure. But when it came to payment, it turned out the service wasn’t included in their policy. Disputes, recalculations, and refusals start, and unfortunately, not only money is lost but also time — yours, your staff’s, and the patient’s.

Such situations can be avoided if your system operates with EDI 270/271.

EDI 270 is an automated electronic request that your clinic or billing system sends to the insurance company before providing the service. It asks: “Does the patient’s insurance cover this specific service?”

EDI 271 is the instant response from the insurer: what is covered, the amount, what remains of the deductible, and if there are any restrictions.

This electronic dialogue replaces dozens of phone calls and manual checks. Most importantly, it minimizes the risk of payment denials and conflicts with patients.

From a business owner’s perspective, this is not just a technical convenience. It’s protection for your revenue, speeding up operations, and enhancing the customer experience.

We help implement and automate EDI 270/271 so that your team won’t even notice how this “insurance intelligence” works. Everything is already checked before the patient sits in the doctor’s office.

Benefits:

- Preventing Denials: Allows you to find out in advance if the service is covered by insurance, reducing the risk of payment denial.

- Improved Customer Service: Provides transparency for patients about their insurance coverage.

- Time Savings: Automated insurance status verification speeds up patient intake.

EDI 278 – Request and Confirmation of Pre-Authorization for Medical Services

When a doctor recommends an MRI, hospitalization, or another expensive procedure, it triggers not only a medical process but also an administrative one. Without prior approval from the insurance company, there is a risk that the service will not be paid for. Unfortunately, this often leads to financial losses for the clinic and stress for the patient, who may find out that “the insurance doesn’t cover it.”

Once again, the solution is EDI 278 — a digital standard that allows clinics to obtain official approval from the insurer in advance. The clinic sends a digital request for procedure approval, and the insurance company returns an automated response — either approved or not, with the reason specified.

For businesses, this means:

✔️ Fewer payment denials.

✔️ A transparent approval process.

✔️ Reliability and confidence in financial flows.

This tool is especially useful for clinics, medical centers, billing companies, and IT systems aiming for automation and reducing operational risks. We recommend reaching out to experts for implementing EDI 278 into your workflows so that the procedure approval process stops being an unpredictable source of stress.

Main Benefits:

- Reduced Delays: Automating the authorization request process speeds up obtaining responses from insurers.

- Reduced Administrative Burden: Reduces the amount of manual work associated with filing and tracking requests.

- Improved Customer Service: Quick approval allows for timely medical services to be provided to patients.

How EDI Reduces Costs: Real Scenarios

If you run a medical business — whether a clinic, laboratory, diagnostic center, or billing company — administrative costs can consume up to 15–20% of revenue. Every paper invoice, manual insurance verification, or phone call to the insurance company costs money, time, and human resources.

How EDI Helps Save More and Earn More — In Numbers and Actions

From Paper Invoices to Digital EDI 837

The doctor submits a payment request via EDI 837 instead of by mail or fax.

Savings: Up to $1.49 per request

Why? No costs for paper, postage, manual input, and errors that often result in claims being denied.

Automatic Payment Matching with EDI 835

Instead of manually verifying payments, the accountant receives a structured file with a complete breakdown (what has been paid, what has been denied, and why).

Savings: Accountant’s working hours → just a few clicks.

Result: Transparent reporting, fewer disputes with patients and insurers.

Insurance Verification Before the Appointment with EDI 270/271

The system automatically requests coverage information from the insurer before the visit.

Benefit: Eliminates unnecessary visits and disputed cases.

You know for sure that the service will be paid for, and you don’t waste resources.

Quick Approvals with EDI 278

When prior authorization is needed (e.g., for an MRI), the request is sent and processed automatically.

Outcome: Faster service delivery, higher income, satisfied patients.

Overall, EDI is the infrastructure that makes your business predictable, profitable, and scalable. True experts not only implement EDI but also optimize processes, choose the best EDI tools for healthcare, test, and provide support at every stage, so you don’t waste resources on routine tasks.

If all participants in U.S. healthcare switched to full EDI automation, the industry could save over $20 billion annually.

To help you better navigate and explain these numbers to your friends and colleagues, feel free to use the table below as a little inspiration for implementing EDI today.

How Much Can Be Saved on Each Transaction (on Average)

| Transaction Type | Savings When Switching from Manual to EDI |

| Submitting an Insurance Claim (837): $1.49 per claim for the provider

Receiving a Payment Response (835): $1.04 per transaction

Insurance Coverage Verification (270/271): $1.23 per verification

Authorization Request (278): $1.31 per request |

Submitting an Insurance Claim (837): $1.49 per claim for the provider

Receiving a Payment Response (835): $1.04 per transaction

Insurance Coverage Verification (270/271): $1.23 per verification

Authorization Request (278): $1.31 per request |

EDI Testing in Industry-Wide Volume Savings

- $20+ billion annually — Potential annual savings in the U.S. healthcare system if all processes are moved to EDI.

- Up to 50% reduction in processing time — according to internal metrics from clinics that have implemented automated claims.

- 30-70% fewer rejected claims — when using EDI 837 validation software on the billing system’s side.

How to Implement EDI Software For Healthcare: 4 Steps That Really Work

1. Evaluate Where Money Is Leaking

Start by looking at which processes in your organization are still dependent on paper, manual input, or Excel files. These may include:

- Submitting insurance claims (CMS-1500 manually?)

- Insurance coverage verification via phone

- Manual review of payments and explanations from insurers

📌 These processes cost clinics 30-70% more per transaction.

2. Choose a Trusted EDI Provide

It’s important not just to buy an EDI solution or find a company that will train you or implement what you request. You need to find a partner who will help integrate it into your processes smoothly, with guaranteed support for future scaling of your business product. Corpsoft Solutions is a team of experts in digital solutions for healthcare that:

- Has a deep understanding of the specifics of medical businesses, whether it’s a private clinic, a network of laboratories, or a medical billing service

- Ensures full HIPAA compliance and secure processing of PHI data

- Adapts and integrates EDI with your EHR/EMR system, accounting, and insurance providers

- And importantly, doesn’t stop at implementation: we continue supporting, refining, and developing the solution as your business grows

Instead of a standard “product,” you get a partner who speaks your language and helps build a system that works for results.

3. Integration + Staff Training

Integrating EDI into your workflow is not just about connecting to a system. It’s about creating an effective and seamless data flow between you, insurance companies, and other medical partners. Here’s how it works:

- Choosing the Integration Method: Start by deciding which integration method works best for you: a cloud solution, a local EDI client, or built-in integration with your EHR/EMR system, such as Epic, Cerner, or AdvancedMD. The choice depends on the size of your clinic or hospital and its specific operations. For large healthcare institutions, integrating into the EHR provides the fastest and most secure connection.

- Connecting to Insurance Company APIs: In this step, we connect your business to the APIs of major insurance companies, enabling automatic updates and claims submissions without delays. This ensures that you won’t have to worry about processes “stalling” or getting lost in paperwork.

- Setting Up Claim Routing: Once connected, we configure the routing for claims submissions to insurance companies, ensuring that each piece of information is directed to the right place without errors or losses. This also includes automatic linking between EDI 835 vs EDI 837 payments, eliminating the need to manually check which claims have been paid or rejected.

- Staff Training: Implementing EDI is impossible without ensuring your staff is trained to work with the new system. Even if the interface seems simple, it’s important to understand how to read rejected claims, how to properly forward EDI 278 (authorization request), or how to reconcile EDI 835 responses (payment information). Without proper training, the risk of errors increases, leading to delays in payments and additional costs.

4. Analysis, Optimization, and Scaling for Continuous Process Improvement

After the system is set up and running, it’s important not to stop at this point. Real success is achieved through constant analysis and optimization of processes for further simplification and business growth:

- Tracking Automated Transaction Share: It’s crucial to aim for 90% of claims and payments being processed automatically. This significantly reduces manual labor, speeds up processing times, and reduces errors. If your automation rate is below this threshold, there’s room for improvement.

- Analyzing Rejection Causes: If more than 10% of your claims are rejected, you need to address bottlenecks in the process. This could be due to incorrect setup or needing additional information for insurers. Each rejection is an opportunity to improve the system and increase efficiency.

- Adding New Types of EDI Messages: It’s important not only to maintain the EDI messages you already use (e.g., 837 and 835) but also to incorporate new types like EDI 270/271 (coverage verification), EDI 278 (pre-authorization), EDI 999 (claim status), and others. The more processes you automate with EDI, the faster and more accurate your business becomes.

Which Healthcare Organizations Are Already Using EDI — And Why You Can’t Afford to Fall Behind

Today, 95% of hospitals and over 85% of doctors in the U.S. are already using EDI for processing insurance claims, coverage verifications, and payment collections. This technology has become not just a convenient addition but a required standard for those who want to survive and thrive in digital healthcare. Large networks of clinics, laboratories, and medical billing services choose EDI because:

- Increased Efficiency: EDI systems allow healthcare organizations to process 30-50% more claims daily without increasing staff, reducing wait times, and speeding up payments.

- Reduced Operational Costs: The average business saves up to $2.10 per claim by eliminating paper-based workflows and reducing errors that lead to resubmissions or rejections.

- Integration with Modern Technologies: Using EDI with EHR systems and accounting software creates a unified, efficient digital process where information is not lost and doesn’t require processing in Excel spreadsheets.

- Automated Denial and Hold Analysis: Implementing EDI allows for the automation of denial and hold analysis, reducing the time spent processing these issues and improving cash flow.

What If You’re Not Using EDI Yet?

It’s like sending letters by mail while all important communication happens via Zoom. Without automation, manual processes not only take time and money but also create a risk of losing customers due to slow processing of their insurance claims.

The question is not whether to use EDI but how quickly you can benefit from it.

Conclusion

View the implementation of EDI as a strategic investment.

You will notice how every step in the process, from submitting insurance claims to receiving payments, becomes automated and precise. The costs associated with manual labor, re-submissions, and errors begin to decrease rapidly. These processes become faster, and staff are freed from routine tasks, allowing them to focus on more important activities — improving service quality and patient care.

What’s important: implementing EDI is not just a technical transformation. It’s an investment in the future of your organization. It not only improves current operations but also strengthens your competitive edge, giving you an advantage in an industry where time equals money. Optimizing processes delivers tangible returns, and you no longer worry about costs — you’ll see those savings come back in the form of improved financial performance and business growth.

Subscribe to our blog